Although the business lines of our various subsidiaries are quite similar, our organization by market ensures a good spread of risks. Most of the markets in which we operate are linked to primary needs. For example: protection from cold and heat (heating and cooling), washing (domestic hot water, sanitation), hydration (drinking water supply), food (food industry), healthcare (pharmaceutical industry). What’s more, most of our products are sold for maintenance and renovation.

These characteristics give us a natural resilience in times of crisis and protect us from cyclical risks. Over the next six years, energy renovation programmes should boost our construction business in France. In the longer term, our Group has a great card to play in Europe in the industrial valves market, which is still fairly fragmented. In 2022, the acquisition of DPI gave us the opportunity to become a supplier to the major players in the French public works sector. Entering this new market means that we can spread our risks even further.

Fluid circuits in buildings = 42.9% of our turnover

We offer all the accessories and equipment needed to ensure the proper circulation of water in heating and sanitary installations for the individual housing, collective housing and tertiary sector markets. We also offer complete ranges for controlling indoor air quality and temperature. Our subsidiaries target wholesalers, DIY superstores, online retailers and certain manufacturers. Regulatory changes (RE2020) aim to save water and energy and reduce carbon emissions from buildings, while ensuring the comfort and safety of residents and users. They stimulate innovation and lead us to offer solutions with higher added value.

MaPrimeRénov, funded by the public authorities, and Energy Savings Certificates, funded by energy suppliers, theoretical funding envelope of around €7 billion for 2024 to €8.3 billion in 2023. Taking all sectors together, energy use is the leading source of greenhouse gas emissions in France, accounting for at least 255 Mt CO2 in 2022, or 63% of the national total. Residential and tertiary buildings emit 64 Mt (16%), making energy renovation a national priority for many years to come (source: https://www.statistiques.developpement- durable.gouv.fr). The bulk of our business is based on maintenance and renovation; these are resilient ‘needs’ markets in which we are very well positioned and highly responsive.

Fluid circuits in industry = 25.6% of our turnover

Most industrial sites carry fluids in liquid or gaseous form. Six of our subsidiaries distribute manual and motorised valves, dampers, filters, fittings and regulation and control accessories tailored to maintenance operations and new-build projects. We are present with virtually all distributors of industrial valves and industrial supplies, engineering companies and some major chemical accounts. We are constantly expanding our product ranges. We are also working with factories to promote our ranges and establish our brands.

Sodeco Valves, based in Belgium, focuses on large industrial sites. This market is likely to be dynamic in the medium term due to Europe’s desire to regain its independence in strategic sectors and the necessary investments to be made for the ecological transition of industry.

Domestic pumps = 17% of our turnover

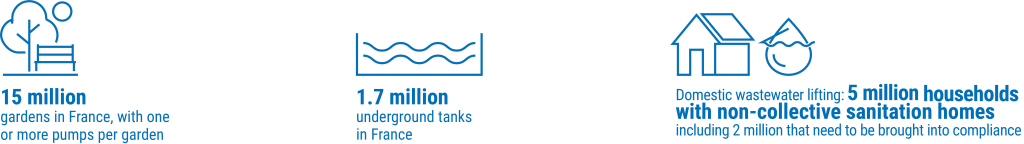

We are a major player in the French market for domestic pumps in professional distribution channels and DIY superstores. Whether for watering, irrigation, supplying water to private homes, transferring and lifting clear or waste water, or managing swimming pools, the market for pumps is, and will remain, important. Successive heatwaves and floods in recent years have helped to increase demand, although this is still dependent on the vagaries of the weather. Our return to the swimming pool market has led us to offer a very wide range of equipment to the professionals who build and renovate them.

Pipes for public works = 6.5% of our turnover

In France, the drinking water network covers around 996,000 kilometres, while the wastewater network covers around 380,000 kilometres (www.tpdemain.com). Currently, the annual renewal rate for these networks is around 0.6% for drinking water and 0.7% for wastewater. (www.eau-entreprises.org). At this rate, it would take around 160 years and 150 years respectively to renew all of this infrastructure.

These figures indicate a significant need for renovation to maintain and improve the performance of drinking water and wastewater networks in France. Our plastic pipes (conduits, pipes and tubes, ducts, drains, fittings, etc.) are used for drinking water, waste water, irrigation, watering, drainage, dredging, gas and biogas, as well as telecommunications, electricity and fibre optic networks. Our customers are specialist wholesalers and major players in the building, public works, network design and construction and irrigation markets.

Heavy tooling equipment for private individuals,

professionals and industry = 8.0% of our turnover

We sell air compressors, generators, welding sets, chargers and high-pressure cleaners to mass retailers and via the web to skilledDIY enthusiasts. To differentiate the offer made to the various DIY players, we use our brands (Mecafer), those of our customers, and also brands operated under licence by our suppliers (Michelin, Stanley, Facom). Under the Nuair and Fini brands, as well as piston compressors and screw compressors, we also sell to automotive and industrial supply professionals. We also sell air tanks and a wide range of accessories.